People would rather talk about many other things than the daunting and awkward “m” word: money. It’s scary to talk about money with aging parents.

The topic can cause disagreements and tension among families. But the critical thing to keep in mind when discussing money, especially with aging parents, is to approach the conversation with concern, respect, and a plan. While the conversation can be challenging to navigate, experts can offer guidance on how to do so in a way that both adult children and parents can express their opinions and everyone involved can come to an agreeable decision.

Approaching the topic of finances with sensitivity, empathy, and respect is very important. You want to lead with loving intentions and let your parents know you want to discuss their financial life because you care.

It’s important to remember that these people are always your parents no matter what the circumstances. Approach the conversation from that place of respect and honor that they are the parents. Recognizing that the relationship has existed now or in the past will color the tone of that conversation. Be simple and direct, but also be understanding.

Getting started

Sit down and have a candid conversation to find specific information such as their parents’ financial planner’s contact information or knowing if there are estate documents or a power of attorney in case financial, medical, or mental health decisions need to be made.

The conversation begins with planning how you’ll approach it — tactfully with love — and realizing that your parents may have been managing their money on their own for many years.

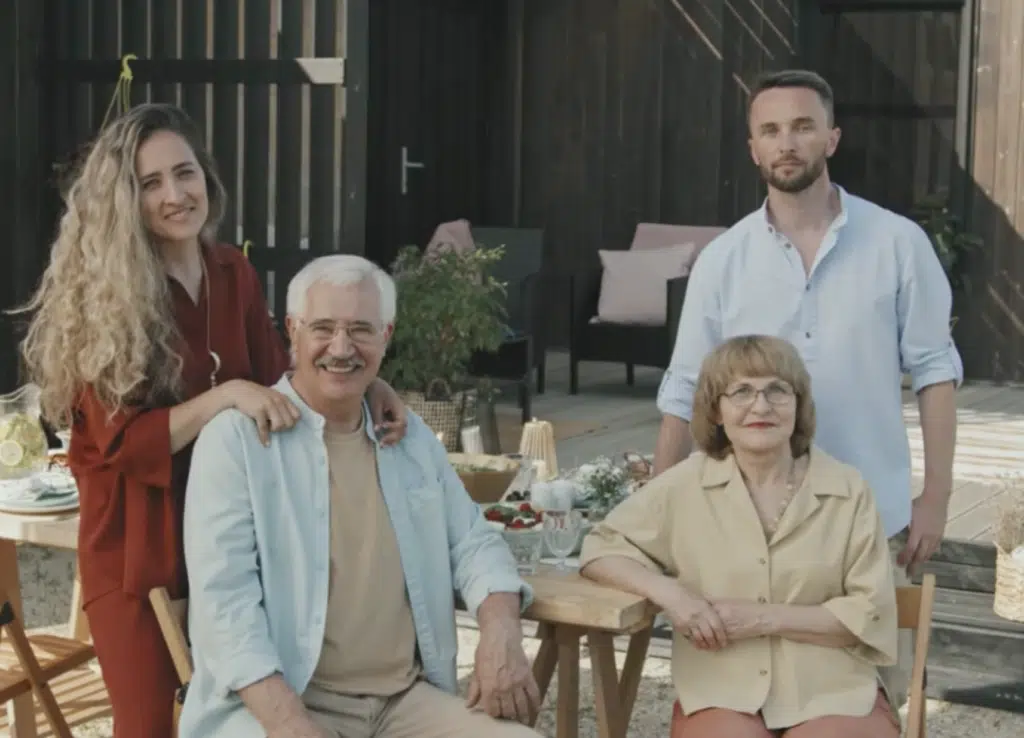

Having this discussion early can help mediate any issues that may arise later and lessen the stress involved. For some families, having a conversation during the holidays can be the best time since most likely the family is together. Choosing a relaxed time where all the involved parties can get together in the same place is vital.

Stressful discussion

Children are out of town sometimes, or parents are no longer able to be involved in those decisions, and the exponential amount of stress that causes to the situation is no fun for anybody to see or have to go through. If you can plan and have that conversation earlier, it puts a road map on how things will be dealt with and what will happen. The peace of mind that all parties get from that is good.

If you can look past the emotions and make a plan ahead of time, it can help ensure that poor decisions aren’t left to chance. It’s really about working with parents to ensure that their wishes are clearly articulated and respected, and reducing misconceptions can help ease family tensions and disharmony.

These discussions, while challenging, can help all family members breathe easier, and if the decisions are made relatively quickly in the middle of a crisis, they may or may not be aligned with the loved ones’ wishes.

The consensus is to have the conversation early and before it’s needed. Often, that can mean when parents are still working or shortly after retirement. If you can discuss it and come to agreement when there is not yet a cloud on the horizon, then that’s the best for all involved.

Don’t wait

Initially, it’s not a big deal, but it starts to build up, and when you start noticing that, the earlier, the better while still respecting your parents’ knowledge about what they do know and what their preferences are.

You don’t have to know everything about your parents’ assets and liabilities. Still, there are certain things to be aware of, such as critical financial and health documents, where they’re kept, and if possible, review them annually to keep them up to date.

It’s also essential to give your parents control whenever possible. You want to reassure them it’s not an attempt to take over their life. You want to offer to help them as they age. Because of the difficult nature of this type of conversation, it can be valuable to consult a professional such as a financial planner or advisor, who can alleviate tension and mediate any conflict to have a productive outcome.

It’s sometimes hard for parents to suddenly have you be the responsible adult in the room; that role reversal can be quite stressful even though everybody understands that you’re doing it out of the best intentions. A third party who has words of wisdom to share and is good at building and bridging relationships goes way beyond the quality of their investment advice or financial knowledge, adding tremendous value.